Risk Management

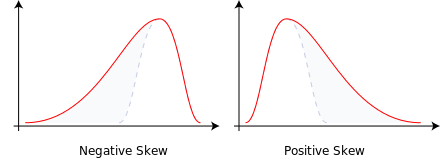

Risk is a slippery concept which is difficult to identify. We can divide the world of risk into predictable risks (or Known Unknowns) and unpredictable risks (Unknown Unknowns). It’s challenging to forecast what the P&L will be each day, but we can model and estimate what the variations in returns is likely to be, based on the recent levels of variation. The element of risk that is encapsulated by a model of variation is the predictable part. The unpredictable risks have not been conceptualised and are rare and extreme events or outliers (“black swans”) in the tails of a probability distribution.

Predictable Risks

The value of 1 standard deviation (1 sigma) about the mean represents a clustering of about 68.2% of data, 2 sigma from the mean include 95.5% of all data and 3 sigma encompass 99.7%, nearly all the data.

Unpredictable Risks

1.5% of the investment capital. The potential lose can be calculated based on Standard Deviation distribution of historical data.

New Strategy Launching The initial position size of each new trading strategy remaining at minimum levels, increasing the position size gradually after the confirmation in real world (even though that there is confidence for positive strategy results).

Market Gaps During market closed periods may happen fundamental events (unknown unknowns) which may cause extremely market movements. There some simple rules that the trading system can follow, like avoid having open short positions for commodities instruments like Oil and Gold, or avoid having open long positions for equities indices during market closed periods. Also, position hedging must be taking into consideration as best pactice.

Securing the break-even Our strategies automatically take the profit on break even.

Portfolio diversification The portfolio diversification can reduce the total trading system risk since the trading is spread among assets with as little relationship to one another as possible. This can be measured as a low correlation. The main inputs for the portfolio diversification are the expected average returns, the standard deviation of returns and their correlation.

Removing emotional trading Emotional trading is when a trader or investor lets personal feelings and emotions impact their decision- making, which most of the times have negative results. Οn the contrary algorithmic automated trading can take decisions based on information and data and not based on human emotions.

Procedural adherence to algorithmic trading rules. Bank of England issued a supervisory statement (SS5/18) relevant to algorithmic trading, providing a series of suggested controls in respect of algorithmic trading activity and risk management. The supervisory statement determines comprehensive procedures about the algorithm approval process, the testing and deployment, the inventories and documentation, the risk management and other controls functions. Our methodology framework has comprehend and adapt the SS5/18 statement.